The Future of Transportation in 2026: Where Innovation, Capital, and Policy Converge

The global transportation industry in 2026 stands at a decisive inflection point, where technological breakthroughs, climate imperatives, and capital flows are converging to redefine how people and goods move across cities, regions, and continents. For the international business audience of BizFactsDaily, transportation is no longer a background enabler of commerce; it has become a central arena in which competitiveness, national strategy, and long-term value creation are being contested. From autonomous logistics and electrified aviation to blockchain-secured supply chains and AI-managed infrastructure, mobility systems are evolving into complex, data-rich platforms that sit at the heart of the modern economy. As investors, executives, founders, and policymakers consider their next moves, understanding the direction of transportation is now inseparable from understanding the future of global business itself.

This transformation is unfolding against a backdrop of shifting macroeconomic conditions, geopolitical realignment, and accelerating digitalization. Governments in the United States, European Union, China, and across Asia-Pacific are reframing transportation not simply as infrastructure, but as a strategic lever for industrial policy, climate commitments, and employment growth. At the same time, technology firms, automakers, logistics giants, and emerging startups are racing to secure leadership positions in what many analysts now describe as the "mobility stack"-the integrated layers of hardware, software, data, and finance that underpin next-generation movement of people and goods. For readers tracking developments across artificial intelligence, banking and finance, global markets, and technology, the future of transportation is a cross-cutting theme that will influence strategy in almost every sector.

Electrification and Beyond: The Maturity of the EV Ecosystem

By 2026, the electrification of road transport has moved decisively from early adoption into the mainstream, particularly in leading markets such as Norway, China, the United States, Germany, and the United Kingdom. Major automakers including Tesla, BYD, Volkswagen, Mercedes-Benz, Ford, and General Motors have shifted a substantial share of their product pipelines toward battery-electric and plug-in hybrid platforms, supported by increasingly stringent emissions regulations and consumer preference for lower operating costs. According to recent analysis from the International Energy Agency, global electric vehicle sales continue to grow at double-digit rates, and EVs are on track to make up a significant portion of new car sales worldwide before 2030, reshaping automotive supply chains from mining to manufacturing and recycling. Business leaders assessing long-term demand patterns can review evolving EV data and policy scenarios through resources such as the IEA's Global EV Outlook.

The electrification wave, however, is no longer confined to passenger cars. Heavy-duty trucks, buses, and commercial fleets are increasingly adopting advanced battery technologies, hydrogen fuel cells, and hybrid systems to comply with decarbonization rules while maintaining operational reliability. Logistics leaders in Germany, France, Italy, and the Netherlands are deploying electric trucks along major freight corridors, supported by megawatt charging infrastructure and smart routing software. Urban transit authorities in cities such as London, Los Angeles, Singapore, and Sydney are committing to fully electric bus fleets within the coming decade, integrating charging infrastructure into broader smart city plans. For executives interested in how this intersects with broader sustainability and growth strategies, additional context is available in BizFactsDaily's coverage of sustainable business transitions.

At the same time, the EV ecosystem is spawning new business models and competitive dynamics in areas such as battery leasing, second-life energy storage, grid services, and charging network operations. Energy utilities, oil and gas majors, and technology platforms are entering the charging market, using data analytics to optimize pricing, location, and energy sourcing. Reports from organizations like the World Economic Forum provide insight into how EVs are reshaping power systems and urban design; leaders can learn more about sustainable mobility strategies to position their companies within this evolving landscape.

AI as the Nervous System of Modern Mobility

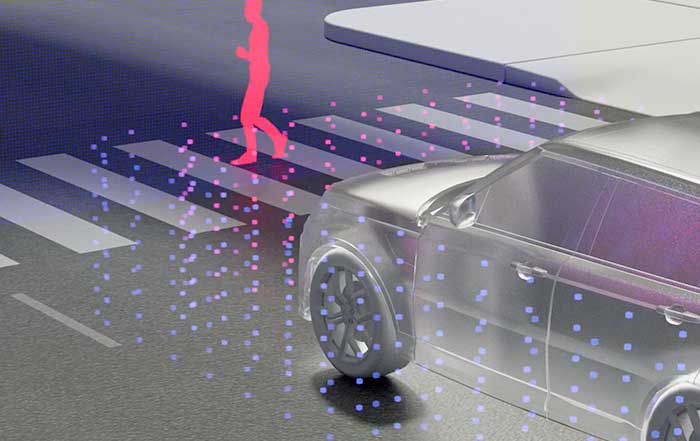

Artificial intelligence has rapidly become the "nervous system" of contemporary transportation, orchestrating decisions across vehicles, infrastructure, and logistics networks. In 2026, AI is embedded in everything from adaptive cruise control and driver assistance systems to predictive maintenance for aircraft and ships, real-time route optimization for freight, and digital twins of entire metropolitan transport systems. Companies such as Waymo, Cruise, Baidu Apollo, Aurora, and Mobileye are advancing autonomous driving capabilities in both passenger and commercial vehicles, often in close collaboration with municipal and national regulators in markets like the United States, China, Japan, and Singapore. Regulatory frameworks are gradually maturing, with safety guidelines, data standards, and liability rules emerging through bodies such as the National Highway Traffic Safety Administration in the US and the European Commission in the EU, whose evolving AI and mobility regulations can be followed on the European Commission's transport policy portal.

Beyond autonomy, AI is transforming how logistics companies, airlines, and shipping firms manage assets and capacity. Predictive maintenance systems use sensor data and machine learning models to anticipate component failures in aircraft engines, rail systems, and container ships, reducing downtime and improving safety. Global players like Boeing, Airbus, Maersk, and CMA CGM are investing in AI-driven analytics platforms that integrate weather, port congestion, fuel prices, and geopolitical risks into real-time routing and scheduling decisions. For investors and strategists, this is not merely an operational upgrade; it is a structural shift in how value is created and captured in transportation, with data and algorithms becoming core assets. BizFactsDaily's dedicated analysis of AI in business and operations provides further perspective on how these tools are being deployed across sectors.

AI's role also extends into public policy and long-term planning. Governments and development banks are increasingly using scenario modeling and AI-enhanced forecasting to prioritize infrastructure investments, assess climate resilience, and evaluate the economic impact of new corridors and ports. Institutions such as the World Bank and OECD publish regular research on transport, urbanization, and digital infrastructure; executives seeking a macro view of AI-enabled planning can explore resources such as the World Bank's Transport Global Practice and the OECD's work on smart cities and transport.

Aviation's Decarbonization Challenge and the Rise of New Flight Technologies

Aviation remains one of the most challenging sectors to decarbonize, yet it is also one of the most active areas of innovation. Airlines across North America, Europe, Asia, and the Middle East are under pressure from regulators, corporate customers, and travelers to reduce emissions while maintaining connectivity and profitability. In response, industry leaders including Airbus, Boeing, Rolls-Royce, and emerging companies such as ZeroAvia, Heart Aerospace, and Eviation are pursuing parallel pathways: sustainable aviation fuels (SAF), hydrogen propulsion, hybrid-electric aircraft, and fully electric regional planes. The International Air Transport Association (IATA) and the International Civil Aviation Organization (ICAO) have set net-zero targets and are working with governments to align standards and incentives; detailed policy and market updates can be accessed through IATA's sustainability initiatives and ICAO's CORSIA and climate programs.

Short-haul routes are likely to see the earliest deployment of electric and hybrid-electric aircraft, particularly in countries with strong renewable energy bases such as Norway, Sweden, Canada, and New Zealand. National aviation authorities and airlines in these markets are running pilot projects for all-electric commuter flights, with the objective of commercial service before 2035. At the same time, major carriers like United Airlines, Lufthansa, Air France-KLM, and Qantas are signing long-term offtake agreements for sustainable aviation fuels, partnering with energy companies such as Neste, Shell, and TotalEnergies to scale production. While SAF remains more expensive than conventional jet fuel, policy instruments in the European Union, the United States, and Japan are gradually narrowing the cost gap through mandates and incentives. Readers tracking global aviation and its economic implications can follow developments via the Air Transport Action Group and BizFactsDaily's broader coverage of the global economy.

For corporate strategists, aviation's transition has direct implications for travel budgets, supply chain design, and carbon accounting. Multinational companies are increasingly integrating low-carbon travel policies, virtual collaboration tools, and route optimization into their broader climate strategies. As sustainability reporting standards tighten, particularly under frameworks such as the ISSB and EU CSRD, transportation-related emissions-Scope 3 in many cases-will be scrutinized by investors and regulators alike.

Smart Infrastructure and the Digital Backbone of Mobility

Vehicles and aircraft can only be as advanced as the infrastructure that supports them. Around the world, governments and city authorities are investing in "smart" transport systems that combine physical assets with digital layers of connectivity, data, and automation. In South Korea, Seoul continues to expand its smart city initiatives with AI-managed traffic signals, 5G-enabled vehicle-to-everything (V2X) communication, and integrated public transport platforms that provide real-time information to commuters. Singapore is advancing its digital twin of the entire city-state, enabling planners to simulate the impact of new transit lines, road pricing schemes, and zoning decisions on congestion, emissions, and economic activity. The United States, under the Bipartisan Infrastructure Law and subsequent initiatives, is funding upgrades to highways, bridges, ports, and railways, with a strong emphasis on resilience, electrification, and digital monitoring; more information on these programs is available through the U.S. Department of Transportation.

In Europe, the Trans-European Transport Network (TEN-T) is being modernized to support cross-border high-speed rail, multimodal freight corridors, and harmonized digital systems for customs and logistics. The European Commission's focus on interoperability and green corridors is reshaping investment decisions from Spain and Italy to Poland and the Nordic countries, aligning infrastructure with climate goals under the European Green Deal. Business leaders can explore how these initiatives impact trade and investment flows through resources such as the TEN-T policy pages and BizFactsDaily's analysis of infrastructure and investment.

For private-sector participants, smart infrastructure opens new opportunities in areas such as sensor networks, cybersecurity, cloud services, and mobility-as-a-service platforms. Technology companies, telecom operators, and financial institutions are partnering with public authorities to design, finance, and operate these systems, often through public-private partnership models. The integration of infrastructure with digital identity, payment systems, and open data frameworks is also creating fertile ground for innovation in insurance, mobility subscriptions, and dynamic pricing, which BizFactsDaily explores within its broader business and technology coverage.

Blockchain, Crypto, and the Quest for Transparent Supply Chains

As supply chains become more complex and globally distributed, the need for transparent, tamper-proof, and efficient logistics records has never been greater. Blockchain technology is emerging as a critical tool in this context, particularly in maritime shipping, air cargo, and intermodal freight. Major players such as IBM, Maersk, CMA CGM, and Hapag-Lloyd have been piloting and deploying distributed ledger solutions to track containers, verify documentation, and automate payments through smart contracts. While some early consortia have evolved or consolidated, the underlying momentum toward digitized, interoperable trade documentation continues, supported by policy efforts like the UN Commission on International Trade Law's work on electronic transferable records, which can be explored via UNCITRAL's e-commerce resources.

In parallel, blockchain is being tested in passenger mobility for secure ticketing, loyalty programs, and decentralized ride-sharing platforms, particularly in markets with high smartphone penetration such as Singapore, South Korea, and parts of Europe. As central banks and regulators in jurisdictions like the European Central Bank, the Bank of England, and the Monetary Authority of Singapore explore central bank digital currencies and updated payment rails, transportation operators are considering how tokenized payments and programmable money could streamline tolling, congestion charges, and cross-border freight settlement. For readers following the intersection of mobility and digital assets, BizFactsDaily's dedicated insights on crypto and blockchain applications provide a focused lens on emerging models.

The broader objective is resilience. Disruptions from the COVID-19 pandemic, port congestion, and geopolitical tensions have exposed vulnerabilities in global logistics. By enabling shared, verifiable records across shippers, carriers, ports, and regulators, blockchain can reduce disputes, fraud, and delays, while improving access to trade finance for smaller firms. Institutions such as the World Trade Organization and the International Chamber of Commerce are actively examining how digital trade documentation and blockchain can modernize global commerce; executives can learn more about digital trade initiatives to anticipate regulatory and competitive shifts.

High-Speed Rail, Hyperloop, and the Geography of Connectivity

While much attention is focused on electrification and autonomy, the strategic redesign of intercity and regional connectivity remains a powerful driver of economic transformation. High-speed rail has already reshaped travel patterns and regional development in China, Japan, France, Spain, and Italy, and continues to expand. China's network, now extending across tens of thousands of kilometers, is increasingly linked to its broader Belt and Road Initiative, connecting domestic growth centers with neighboring markets in Southeast Asia and Central Asia. Data and analysis from the International Union of Railways illustrate how high-speed rail correlates with regional productivity, tourism, and urbanization, offering valuable insights for policymakers and investors.

In Europe, new and upgraded high-speed lines are being planned or constructed between major city pairs, while in the United States, long-discussed projects such as the California high-speed rail and private intercity services in Texas and the Northeast are gradually advancing, supported by federal funding and state-level initiatives. Meanwhile, hyperloop concepts-spearheaded by organizations such as Zeleros and research consortia in Europe, India, and the Middle East-remain in the experimental stage, yet continue to attract interest as potential long-term alternatives for ultra-fast, low-emission travel.

For businesses, the strategic significance of high-speed connectivity lies not only in passenger convenience but in the reconfiguration of labor markets, logistics hubs, and real estate values. Regions connected by fast, reliable rail can function more like integrated economic zones, enabling companies to tap wider talent pools and more flexible supply chains. BizFactsDaily's coverage of employment trends and global economic shifts highlights how transport infrastructure decisions today will influence competitiveness for decades.

Autonomous Logistics, Drones, and the New Last Mile

The logistics sector is experiencing a profound shift as automation, robotics, and AI reshape warehousing, line-haul transport, and last-mile delivery. Companies such as Amazon, UPS, FedEx, JD.com, and Alibaba are deploying autonomous delivery robots, drones, and self-driving trucks in targeted markets, particularly in the United States, China, Australia, and parts of Europe. Drone delivery, once a speculative concept, is now operational for medical supplies, e-commerce parcels, and critical components in both urban and rural environments. Pioneers like Zipline and Matternet have demonstrated the viability of drone networks for healthcare logistics in Rwanda, Ghana, Switzerland, and beyond, with regulatory frameworks gradually adapting to accommodate routine operations. The Federal Aviation Administration, EASA, and other regulators provide ongoing updates on unmanned aircraft systems on platforms such as the FAA's UAS portal, which business leaders can monitor to understand the pace of regulatory change.

On highways, autonomous and semi-autonomous trucks are being trialed on long-haul routes, often operating in platoons to improve fuel efficiency and safety. Companies like TuSimple, Aurora, Embark, and Einride are collaborating with major shippers and fleet operators to integrate these technologies into existing logistics networks, particularly in regions facing driver shortages such as North America and Western Europe. Warehouses and fulfillment centers are increasingly automated with robotics from firms like Ocado, Kiva Systems (now part of Amazon), and GreyOrange, creating end-to-end systems where human workers oversee and manage fleets of machines rather than performing repetitive manual tasks.

These trends have direct implications for labor markets, cost structures, and competitive dynamics in retail, manufacturing, and healthcare. As BizFactsDaily explores in its coverage of employment transformations, the shift toward autonomous logistics is not simply about job displacement; it is about redefining roles, skills, and organizational structures in a sector that underpins global commerce.

Maritime Transport, Ports, and the Decarbonization Imperative

Maritime transport remains the backbone of international trade, moving the vast majority of goods that underpin the global economy. Yet the sector is under intensifying pressure to decarbonize in line with climate goals. The International Maritime Organization (IMO) has strengthened its greenhouse gas strategy, pushing for deeper emissions reductions by mid-century and setting the stage for a transition toward low- and zero-carbon fuels such as green methanol, ammonia, hydrogen, and advanced biofuels. Detailed guidance and progress updates are available through the IMO's climate and air pollution portal, which is increasingly central reading for executives in shipping, energy, and trade finance.

Shipping companies including Maersk, CMA CGM, Hapag-Lloyd, and MSC are ordering dual-fuel and alternative-fuel-ready vessels, while ports in Singapore, Rotterdam, Hamburg, Los Angeles, and Shanghai are investing in shore power, bunkering infrastructure for new fuels, and digital systems to optimize vessel turnaround times. Green shipping corridors-routes where vessels, ports, and fuel suppliers coordinate to minimize emissions-are emerging as testbeds for future standards, supported by public-private initiatives and international coalitions. Analytical work from the Global Maritime Forum and the Getting to Zero Coalition, accessible via the Global Maritime Forum's decarbonization resources, offers valuable insights into the economics, policy frameworks, and technology pathways shaping this transition.

For financial institutions and investors, maritime decarbonization is both a risk and an opportunity. Lenders are increasingly aligning portfolios with frameworks such as the Poseidon Principles, which link ship finance to climate targets, while insurers and cargo owners are beginning to differentiate between carriers based on emissions performance. BizFactsDaily's reporting on sustainable investment and stock market dynamics underscores how these shifts are influencing capital allocation and valuation in the broader transportation ecosystem.

Capital, Markets, and the Financing of Mobility Transformation

The scale of investment required to transform global transportation is immense, spanning vehicles, infrastructure, digital platforms, and energy systems. Venture capital, private equity, infrastructure funds, sovereign wealth funds, and development banks are all expanding their exposure to mobility-related assets. Data from platforms such as PitchBook and CB Insights show sustained funding in electric mobility, autonomous systems, battery technology, and logistics software, even amid broader market volatility. Major sovereign investors from Norway, Singapore, Saudi Arabia, Qatar, and Abu Dhabi are targeting long-term projects in high-speed rail, airports, ports, and smart cities, viewing transportation as a durable pillar of economic diversification.

In parallel, public markets are closely tracking the performance of listed mobility companies, from EV manufacturers and battery producers to airlines, shipping lines, and logistics platforms. The valuation of firms like Tesla, BYD, NIO, and Li Auto continues to reflect not only near-term sales but expectations about market share, software monetization, and ecosystem control. Traditional automakers are being re-rated based on the credibility of their electrification and software strategies. For investors, transportation is now deeply intertwined with themes such as climate transition, digital infrastructure, and AI, which BizFactsDaily regularly analyzes in its stock market and economy coverage.

New financing models are also emerging. Green bonds, sustainability-linked loans, and blended finance structures are being used to fund rail lines, metro systems, charging networks, and port upgrades. Development institutions such as the European Investment Bank and the Asian Development Bank are playing catalytic roles, particularly in Asia, Africa, and Latin America, where infrastructure gaps remain significant. Executives and policymakers can explore these instruments through resources like the EIB's transport lending pages and the ADB's transport sector work, which highlight how public and private capital are being combined to accelerate sustainable mobility.

Employment, Skills, and the Human Dimension of Mobility Change

Beneath the technological and financial headlines lies a profound transformation of the workforce. The transportation revolution is reshaping employment patterns in manufacturing, logistics, infrastructure, and services across North America, Europe, Asia, Africa, and South America. While automation and AI are reducing the need for certain repetitive tasks-such as manual sorting in warehouses or long-haul driving under certain conditions-they are simultaneously creating demand for new skills in software engineering, data science, systems integration, cybersecurity, battery production, and maintenance of advanced equipment.

Countries like Germany, South Korea, Japan, and Canada are investing heavily in vocational training and reskilling programs to prepare workers for roles in electric powertrains, hydrogen systems, and digital operations centers. The International Labour Organization (ILO) and OECD provide ongoing analysis of how technology and climate policies are affecting jobs in transport and related sectors; business and HR leaders can consult resources such as the ILO's Future of Work in Transport and OECD skills and work studies to inform workforce strategies.

For the BizFactsDaily audience, the key takeaway is that talent strategy is now inseparable from transportation strategy. Companies that invest early in reskilling, apprenticeships, and partnerships with universities and technical institutes will be better positioned to harness new technologies and meet regulatory expectations. BizFactsDaily's dedicated section on employment and labor markets continues to track how mobility trends are influencing hiring, wages, and productivity across regions.

Strategy Outlook to 2035: Positioning for a New Mobility Paradigm

Looking ahead to 2035, transportation is set to become even more deeply integrated with digital platforms, energy systems, and global value chains. Urban areas from New York and Toronto to London, Berlin, Shanghai, Singapore, Sydney, and Dubai are likely to be dominated by electric, connected, and increasingly autonomous fleets, supported by intelligent infrastructure and dynamic pricing mechanisms. Intercity and regional travel will rely more heavily on high-speed rail and low-carbon aviation, while maritime trade will be shaped by alternative fuels, green corridors, and advanced logistics analytics. For businesses, these shifts will redefine everything from site selection and supply chain design to customer expectations and brand positioning.

For readers of BizFactsDaily, the core strategic question is how to align corporate and investment decisions with this evolving mobility paradigm. That alignment requires integrating insights across domains: understanding how artificial intelligence will orchestrate traffic and logistics, how financial systems and banking will support infrastructure and fleet renewal, how innovation and technology will create new business models, and how global economic forces and regulation will shape market access and competitiveness. Transportation is no longer a peripheral consideration; it is a central axis around which sustainable growth, resilience, and competitive advantage will be built.

BizFactsDaily will continue to follow this transformation closely, drawing on global expertise, data, and on-the-ground developments to provide the experience-based, authoritative, and trusted analysis that decision-makers require. In a world where mobility underpins trade, employment, and innovation, those who understand the trajectory of transportation will be best positioned to navigate uncertainty, capture emerging opportunities, and create enduring value in the decade ahead.