Real-Time Marketing Intelligence in 2026: How Data is Redefining Competitive Advantage

Real-Time Data Becomes Core Business Infrastructure

By 2026, real-time data has moved decisively from experimental marketing edge to foundational business infrastructure, and the editorial team at BizFactsDaily.com has seen this shift unfold across industries, regions, and company sizes. What began as a way to optimize digital ad bids or personalize website content has evolved into an enterprise-wide capability that shapes how organizations understand customers, allocate capital, manage risk, and communicate with markets in an environment where conditions can change in minutes rather than months. The leaders in this transition are not simply the largest or best-funded enterprises; they are the organizations that combine deep technical competence with disciplined data governance, a clear strategic narrative for why real-time insight matters, and a demonstrable respect for customer privacy and societal expectations.

For readers who follow how artificial intelligence, cloud platforms, and automation are redefining decision-making, the maturation of real-time marketing mirrors broader transformations in digital operations and analytics. Businesses that once relied on static dashboards and quarterly reports now treat data as a living asset, continuously refreshed and interrogated to guide both tactical and strategic choices. Those who have been tracking how artificial intelligence is transforming business decisions and how digitalization is reshaping the global economy will recognize real-time marketing as one of the most visible and commercially consequential expressions of this wider shift.

From Historical Reporting to Living Intelligence

For much of the 2000s and early 2010s, marketing analytics was essentially backward-looking: campaign post-mortems, monthly performance summaries, and retrospective attribution models that attempted to explain what had already happened. By the time these insights were compiled, customer behavior, competitive positioning, and macroeconomic conditions had often moved on, leaving brands in a reactive posture. The explosion of digital touchpoints, the ubiquity of smartphones, and the proliferation of connected devices have fundamentally changed this equation, enabling data to be captured, processed, and acted upon in milliseconds across web properties, mobile apps, in-store systems, and connected products.

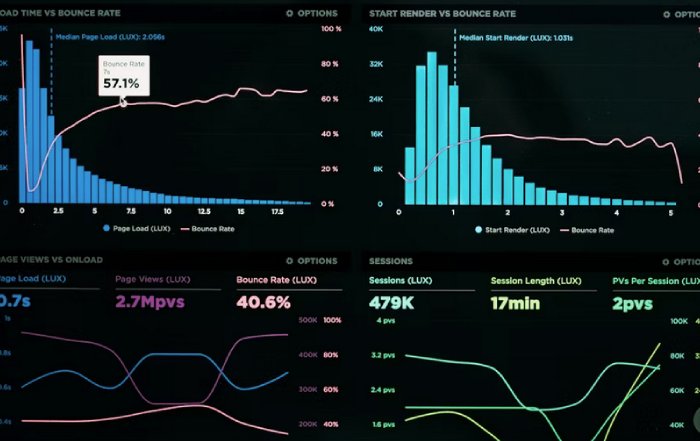

Today, many organizations that once waited weeks for performance metrics monitor live dashboards that continuously update key indicators such as conversion rates, engagement, churn risk, and inventory positions, and these dashboards are increasingly tied directly to automated decision engines that adjust bids, creative variants, and offers in real time. The underlying feasibility of this living intelligence is the result of advances in cloud computing, in-memory processing, and streaming analytics, supported by hyperscale providers such as Amazon Web Services, Microsoft Azure, and Google Cloud, each of which offers native tools for ingesting, transforming, and analyzing high-velocity data streams. Executives seeking a technical grounding in these capabilities can review resources such as Google Cloud's data analytics overviews to understand how these architectures support modern marketing use cases, while the editorial stance at BizFactsDaily.com remains focused on how such technology is converted into tangible business value through leadership, process design, and governance.

The Architecture of Real-Time Marketing Intelligence

Behind every mature real-time marketing program lies a carefully designed architecture that captures, unifies, and analyzes data without introducing delays or fragmentation that would undermine its usefulness. In 2026, leading organizations typically converge on a few core layers: event streaming pipelines that collect behavioral and transactional data from websites, apps, point-of-sale systems, customer relationship management platforms, and advertising technology; customer data platforms that resolve identities and maintain unified profiles; analytics engines that run descriptive, predictive, and prescriptive models; and activation layers that feed decisions back into ad platforms, email systems, mobile push notifications, call centers, and on-site personalization engines.

Where marketers once depended on static spreadsheets or disconnected reporting tools, they now work with dynamic interfaces powered by platforms such as Snowflake and Databricks, which support continuous data ingestion and advanced analytics at scale. Observers interested in how such platforms are evolving can explore the Snowflake resource library for examples of real-time data strategies in marketing and beyond. At the same time, the rise of real-time marketing is inseparable from the broader adoption of AI and machine learning, which allow organizations to interpret continuous data streams at a speed and complexity far beyond human capacity. Coverage on technology and innovation at BizFactsDaily.com has consistently shown that the most successful implementations treat analytics not as a separate reporting function but as an embedded intelligence layer across operational workflows, from dynamic pricing in e-commerce to churn prevention in subscription models.

Experience: How Leading Brands Operationalize Real-Time Data

Organizations that extract the greatest value from real-time data treat it as a cross-functional capability rather than a narrow marketing initiative. They integrate marketing, product, sales, finance, risk, and operations around a shared view of the customer and a common set of metrics, ensuring that the promises made in campaigns are grounded in operational reality. In sectors such as retail, banking, travel, and telecommunications, leading firms use real-time insight to synchronize inventory, pricing, and promotions, reducing the risk of stockouts, over-discounting, or misaligned offers that erode trust and margins. Analyses from bodies such as the World Economic Forum illustrate how digital transformation and real-time data are reshaping customer expectations across North America, Europe, and Asia, and these patterns are reflected in case studies and commentary appearing regularly on BizFactsDaily.com.

In financial services, institutions including JPMorgan Chase, HSBC, and DBS Bank have invested heavily in real-time transaction monitoring and behavioral analytics that serve dual purposes: detecting fraud within milliseconds and tailoring offers or advice at the moment of engagement. Readers who follow developments in banking will recognize how these capabilities intersect with instant payments, open banking, and embedded finance. Similarly, in technology and e-commerce, organizations such as Amazon, Alibaba, and thousands of Shopify-powered merchants use clickstream data, search queries, and purchase histories to refine product recommendations, content, and promotions on the fly. Research from sources like MIT Sloan Management Review has documented how such data-driven personalization, when implemented with care and transparency, can materially improve conversion, order value, and loyalty, especially in highly competitive markets such as the United States, the United Kingdom, Germany, and Singapore.

Expertise: Converting Data into Insight and Action

Possessing large volumes of real-time data does not automatically translate into meaningful insight or effective action. Expertise resides in the ability to distinguish signal from noise, to define metrics that align with long-term strategic objectives, and to embed those metrics into decision-making processes at the right levels of the organization. Advanced marketing teams in 2026 have largely moved beyond surface-level indicators such as click-through rates and last-touch attribution, and instead construct models that link live campaign performance to downstream outcomes such as customer lifetime value, incremental revenue, and cross-channel halo effects. This evolution reflects a broader trend toward outcome-based marketing measurement, which has been analyzed in depth by firms such as McKinsey & Company.

For the BizFactsDaily.com audience, which includes senior marketers, founders, and investors, this shift underscores the importance of investing not only in tools but also in analytical talent and organizational design. Real-time data requires clear decision rights and well-defined playbooks that specify which actions can be automated, which require human review, and how thresholds should trigger changes in creative, targeting, or budget allocation. Organizations that regularly consult resources on business strategy and marketing investment understand that a mature experimentation culture and robust governance are essential to avoid both over-automation and decision paralysis. Thought leaders such as Rita McGrath and Byron Sharp have long argued for evidence-based, adaptive marketing, and articles in publications like Harvard Business Review provide concrete examples of how companies integrate real-time insights into annual planning, quarterly reviews, and day-to-day execution.

Real-Time Data Across Search, Social, and Physical Channels

As customer journeys have become more fragmented across devices, platforms, and geographies, the strategic value of real-time data lies in its ability to provide continuity and context. In paid search and programmatic advertising, real-time bidding has been standard for years, but the sophistication of these systems has deepened considerably, with algorithms now incorporating first-party behavioral data, contextual relevance, and AI-driven creative variations to decide which impression to buy and which message to serve. Marketers seeking to understand these dynamics in greater depth can refer to standards and best practices from organizations like the Interactive Advertising Bureau, which plays a central role in shaping data-driven advertising across the United States, Europe, and Asia.

Social platforms such as Meta, TikTok, LinkedIn, and X (formerly Twitter) function as real-time observatories of sentiment, cultural shifts, and campaign resonance. Brands monitor mentions, engagement, and share-of-voice to refine content strategies within hours, while risk and communications teams use the same data as an early warning system for reputational threats or product issues. For readers who follow news and market developments, these social signals increasingly complement traditional research and media monitoring. Offline environments are equally influenced by real-time capabilities: in-store sensors, computer vision systems, and advanced point-of-sale platforms generate continuous data on foot traffic, dwell time, and purchasing behavior, which in turn inform queue management, staffing, and personalized offers delivered via mobile apps or digital signage. The National Retail Federation has highlighted how retailers in the United States, Europe, and Asia-Pacific use such tools to improve both customer experience and operational efficiency, and BizFactsDaily.com continues to track how these practices migrate from early adopters to the broader market.

AI, Predictive Analytics, and Generative Content in 2026

While real-time data describes what is happening now, the most significant competitive advantage arises when organizations use that data to anticipate what will happen next. Machine learning models trained on historical and streaming data can forecast demand, identify at-risk customers, recommend next-best actions, and detect anomalies that may signal fraud, technical problems, or creative fatigue. These capabilities are particularly valuable in sectors such as e-commerce, banking, insurance, and subscription media, where small shifts in churn or conversion rates can have outsized financial impact. Business leaders who want to deepen their understanding of AI in finance and commerce can consult resources such as the OECD's work on AI in business and finance, and can follow ongoing coverage of AI applications in business on BizFactsDaily.com.

By 2026, generative AI has become a standard component of many marketing technology stacks, enabling rapid creation, testing, and adaptation of content. Foundational models from OpenAI, Anthropic, Cohere, and other providers are integrated into campaign management systems to generate copy, imagery, and even video variants that respond to live performance signals and individual customer context. At the same time, regulators and industry bodies have intensified efforts to establish guardrails for transparency, bias mitigation, and accountability in AI-generated communications. The European Commission's digital strategy on AI, alongside emerging frameworks in the United States, the United Kingdom, and across Asia-Pacific, directly influences how brands design and deploy AI-driven marketing tools. Organizations with global footprints must interpret these evolving rules while maintaining consistent brand standards and ethical practices, a challenge that BizFactsDaily.com frequently examines in the context of cross-border digital business.

Trust, Privacy, and Regulation in a Real-Time Landscape

The acceleration of real-time data capabilities has coincided with a profound recalibration of privacy expectations and regulatory oversight worldwide. Frameworks such as the EU General Data Protection Regulation (GDPR), the California Consumer Privacy Act (CCPA) and its successors, Brazil's LGPD, South Africa's POPIA, and data protection laws across Asia and the Middle East have established stringent requirements for consent, purpose limitation, data minimization, and user rights. Marketers must therefore design real-time strategies that are as much about compliance and trust as they are about personalization and performance. Business leaders can deepen their understanding of these obligations through resources from the European Data Protection Board and the International Association of Privacy Professionals, both of which provide practical guidance on operationalizing privacy by design.

At the same time, the deprecation of third-party cookies, stricter mobile tracking policies, and heightened scrutiny of cross-border data transfers have accelerated a pivot toward first-party and zero-party data strategies. For the BizFactsDaily.com community, this shift reinforces the importance of building strong value exchanges-loyalty programs, premium content, tailored services-that encourage customers to share data voluntarily in return for clear benefits, a theme closely aligned with coverage on sustainable business practices and long-term brand equity. Research from organizations such as the Pew Research Center shows that while consumers across North America, Europe, and Asia increasingly expect personalized experiences, they are also more sensitive to perceived overreach and opaque data use. Brands that are transparent, provide meaningful controls, and use real-time insights to genuinely enhance experiences rather than to exploit vulnerabilities are better positioned to sustain trust in highly regulated and socially conscious markets.

Real-Time Intelligence in Crypto, Fintech, and New Frontiers

Real-time data is not only transforming established sectors; it is also foundational to emerging domains such as crypto, digital assets, and decentralized finance, where markets operate continuously and volatility can be extreme. Exchanges, trading platforms, and custodians depend on live order books, on-chain analytics, and sentiment indicators to manage risk and inform both product and marketing decisions, while communications teams must respond quickly to regulatory announcements, security incidents, or social media narratives that can move markets in seconds. Readers who follow crypto and digital asset coverage on BizFactsDaily.com understand that real-time intelligence is as much about reputation and compliance as it is about trading strategy. Educational resources from industry outlets like CoinDesk and regulatory updates from bodies such as the U.S. Securities and Exchange Commission provide further context on how data, regulation, and risk intersect in these fast-moving environments.

Fintech innovators across the United States, the United Kingdom, the European Union, Singapore, Australia, and the Nordic countries are similarly leveraging real-time data to redesign financial products and experiences. Instant credit scoring based on live cash flows, dynamic insurance pricing that responds to behavior, and real-time small business lending decisions are reshaping expectations for responsiveness and transparency. For readers exploring global financial and business trends, reports from the Bank for International Settlements and the International Monetary Fund offer a macro view of how real-time data and digital infrastructure are transforming financial intermediation and inclusion across developed and emerging markets.

Measuring Business Impact and Market Perception

For boards, investors, and senior executives, the central question is whether real-time data capabilities translate into measurable business outcomes. Over the past several years, empirical evidence has accumulated that organizations with advanced analytics and real-time decisioning capabilities outperform peers on revenue growth, margin expansion, customer retention, and innovation speed. Studies and surveys from firms such as Deloitte have linked data maturity with higher marketing return on investment, more efficient media allocation, and improved customer satisfaction across industries ranging from retail and consumer goods to banking and telecommunications.

Real-time data also plays an increasingly prominent role in capital markets. Analysts, hedge funds, and asset managers now incorporate alternative and high-frequency data-web traffic, app usage, transaction proxies, social sentiment-into models that aim to predict company performance between earnings cycles. For the BizFactsDaily.com audience that follows stock markets and investment trends, this development underscores a critical point: the same operational data that marketing teams use internally to optimize campaigns can influence external valuations and investor confidence. Publications from the CFA Institute explore both the opportunities and ethical considerations associated with such practices, including questions of data provenance, fairness, and information asymmetry.

Talent, Culture, and Governance: Building Sustainable Capability

Organizations at earlier stages of their real-time journey often discover that technology is the easiest part of the transformation; the more challenging work involves talent, culture, and governance. Companies need professionals who can bridge marketing, data science, engineering, and product management, and they must also upskill existing marketers to interpret complex data and collaborate effectively with technical colleagues. This talent challenge is particularly acute in competitive labor markets across the United States, the United Kingdom, Germany, Canada, Australia, and fast-growing hubs in Asia. Readers interested in employment trends and skills evolution can find valuable context in the World Economic Forum's Future of Jobs reports, which highlight data and AI literacy as critical capabilities across business functions, including marketing and sales.

Culturally, organizations that succeed with real-time data foster a test-and-learn mindset, where hypotheses are continuously evaluated, experiments are rigorously designed, and failures are treated as learning opportunities rather than reasons to retreat to intuition. Governance frameworks must balance the desire for speed with the need for control, defining standards for data quality, privacy, model validation, and accountability for automated decisions, especially when those decisions affect pricing, eligibility, or content exposure. As companies scale real-time capabilities across multiple jurisdictions in Europe, Asia, Africa, and the Americas, they must adapt these frameworks to diverse regulatory regimes and cultural expectations. International guidance on data governance policy from organizations such as the OECD can help boards and executive teams design structures that support innovation while protecting customers, employees, and shareholders.

The Strategic Horizon: Real-Time Data as a Source of Durable Advantage

By 2026, the emergence of real-time marketing intelligence is no longer a niche innovation but a defining characteristic of competitive, customer-centric organizations operating in a volatile and interconnected global economy. For the readership of BizFactsDaily.com, which spans decision-makers in technology, finance, retail, manufacturing, professional services, and high-growth ventures across North America, Europe, Asia, Africa, and South America, the strategic implications are clear. Real-time data capabilities are becoming as fundamental as core financial systems or supply chain platforms, and treating them as peripheral marketing tools risks ceding advantage to more agile, data-literate competitors.

As businesses navigate inflation cycles, geopolitical uncertainty, supply chain disruptions, and rapidly evolving consumer expectations, the ability to perceive, interpret, and act on signals in real time will increasingly differentiate those that merely respond to market forces from those that shape them. This reality cuts across all the domains that matter to the BizFactsDaily.com community: from marketing strategy and business model innovation to the structure of the global economy and the evolution of technology, finance, and employment. For organizations at any stage of their journey, staying informed through rigorous analysis and grounded case studies is essential, and BizFactsDaily.com remains committed to providing the insights, context, and perspectives that business leaders need to turn real-time data into enduring competitive advantage.