How AI Is Rewiring Global Finance in 2026: Risks, Opportunities, and the Road to Autonomous Money

The finance industry in 2026 finds itself in the midst of a structural reset rather than a cyclical evolution, with artificial intelligence no longer sitting at the edge of experimentation but operating as a foundational layer across banking, capital markets, insurance, payments, and emerging decentralized ecosystems. At BizFactsDaily, ongoing coverage of artificial intelligence in business has made it clear that what began as pilot projects in chatbots and process automation has matured into end-to-end AI platforms that influence credit allocation, trading behavior, fraud defenses, regulatory compliance, and even monetary policy debates. For financial institutions in the United States, Europe, Asia, and beyond, AI adoption is now a condition of survival rather than a differentiator, particularly as digital-native competitors and technology platforms encroach on activities once reserved for regulated banks and asset managers.

This transformation is unfolding against a backdrop of tighter regulation, geopolitical fragmentation, and heightened expectations from both retail consumers and institutional clients for instant, hyper-personalized, and low-cost financial services. As AI models become more powerful and more deeply embedded into operational and strategic decisions, they also introduce new vectors of systemic risk, ethical complexity, and cyber vulnerability that boards and regulators cannot ignore. The following analysis, developed for the global business audience of BizFactsDaily, examines how AI is reshaping finance in practice, the regional patterns that define adoption, and the critical governance questions that will determine whether AI-driven finance enhances resilience and inclusion or amplifies volatility and exclusion.

AI-Driven Banking: From Static Products to Dynamic, Data-Rich Systems

Across retail and corporate banking, AI has shifted the sector away from product-centric models toward data-driven, continuously learning systems that respond in real time to customer behavior, macroeconomic signals, and regulatory constraints. Traditional underwriting that once relied on a narrow set of financial ratios and credit bureau scores is giving way to multi-dimensional risk engines that synthesize transaction histories, employment records, cash-flow volatility, and in some markets alternative signals such as mobile usage or digital commerce behavior. Institutions such as JPMorgan Chase, HSBC, and digital challengers like Revolut and Monzo now deploy machine learning models that dynamically price risk and extend credit, with AI-based decisioning reducing default rates while expanding access to borrowers who previously fell outside conventional scoring models. Readers can explore how these shifts intersect with broader structural changes in banking, including consolidation, fintech competition, and regulatory pressure.

This shift is particularly consequential in emerging markets across Africa, South Asia, and Latin America, where large segments of the population lack formal credit histories. By drawing on alternative data sources, AI-enabled lenders are able to construct risk profiles for small merchants, gig workers, and rural households, thereby contributing to financial inclusion while maintaining portfolio discipline. However, as central banks and organizations such as the World Bank and International Finance Corporation emphasize in their financial inclusion reports, the use of non-traditional data also raises concerns about privacy, consent, and the potential for opaque correlations to encode social or ethnic bias. Responsible deployment therefore requires governance frameworks that go beyond technical performance and explicitly address fairness, explainability, and recourse mechanisms for customers adversely affected by automated decisions.

Fraud detection and cybersecurity represent another area where AI has moved from optional enhancement to critical infrastructure. With digital payments, instant transfers, and open banking APIs expanding the attack surface, banks and payment providers now rely on real-time anomaly detection models that monitor hundreds of signals per transaction-device fingerprints, geolocation, behavioral biometrics, and historical spending patterns-to flag suspicious activity within milliseconds. Mastercard's Decision Intelligence and Visa Advanced Authorization, for example, combine supervised and unsupervised learning to improve fraud detection while reducing false declines that frustrate legitimate customers. PayPal and other global payment platforms similarly use AI to correlate patterns across billions of transactions, detecting coordinated fraud rings that would be invisible to rule-based systems. Studies from organizations like the Financial Action Task Force demonstrate that such technology, when combined with robust know-your-customer (KYC) processes, materially improves anti-money-laundering outcomes, though it also pushes criminals toward more sophisticated tactics, creating an ongoing arms race.

On the customer experience side, AI-powered conversational interfaces are now embedded in mobile banking apps across North America, Europe, and Asia-Pacific, with Bank of America's Erica, Wells Fargo's Fargo, and similar assistants in the UK, Germany, and Singapore handling billions of interactions annually. These systems provide real-time spending insights, cash-flow alerts, and proactive recommendations to move idle balances into higher-yield products or accelerate debt repayment. For banks, they offer a dual advantage: lower servicing costs and a rich stream of behavioral data that feeds personalization engines and product design. For customers, they lower friction and increase financial literacy, provided explanations remain transparent and free from manipulative nudging. As BizFactsDaily has highlighted in its coverage of technology-driven business models, the competitive frontier in retail finance is increasingly defined by the quality of digital experiences rather than the physical branch footprint.

AI in Capital Markets and Wealth Management: Speed, Scale, and New Governance Questions

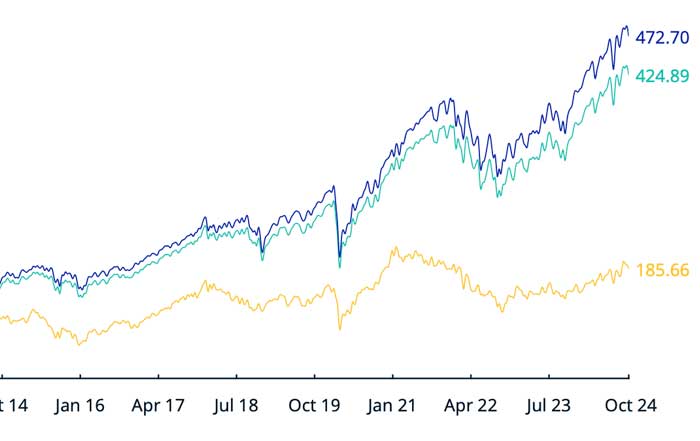

In capital markets, AI-based trading and risk systems have become deeply entrenched, especially in the United States, United Kingdom, Germany, and Japan, where liquidity and data availability are highest. Algorithmic trading desks at firms such as Goldman Sachs, Morgan Stanley, and leading quantitative hedge funds routinely deploy reinforcement learning, deep neural networks, and natural language processing to identify patterns across market microstructure data, earnings transcripts, macroeconomic releases, and even satellite imagery or shipping data. These models operate across asset classes-equities, fixed income, FX, commodities, and cryptoassets-seeking marginal advantages measured in basis points and microseconds. As regulators like the U.S. Securities and Exchange Commission (SEC) and the European Securities and Markets Authority (ESMA) continue to analyze the impact of algorithmic trading on market stability, they increasingly call for stress testing of AI-driven strategies, circuit breakers, and transparency around model behavior during periods of stress. Readers interested in the evolving structure of trading venues and liquidity can delve deeper into stock market dynamics and the interplay between human and machine decision-making.

Beyond high-frequency trading, AI is transforming portfolio construction and wealth management. Robo-advisory platforms such as Betterment, Wealthfront, and Charles Schwab Intelligent Portfolios have scaled across the United States, Canada, and parts of Europe, using algorithms to match investors with diversified portfolios aligned to risk tolerance, goals, and time horizons. Initially focused on low-cost index strategies, many of these platforms now incorporate tax-loss harvesting, factor tilts, and even environmental, social, and governance (ESG) overlays, responding to heightened interest in sustainable investing. Traditional private banks and wealth managers in financial centers like New York, London, Zurich, and Singapore increasingly use AI as a co-pilot for human advisors, generating scenario analyses, identifying clients at risk of churn, and recommending next-best actions. Research from institutions such as the CFA Institute underscores that clients still value human judgment and relationship-based advice, but they expect that advice to be augmented by sophisticated analytics rather than built on static spreadsheets.

Generative AI adds another layer to this transformation. Large language models trained on financial data, regulatory texts, and historical disclosures are now used to draft research notes, summarize earnings calls, and generate first-draft investment theses, significantly compressing the time from information release to analytical insight. Tools inspired by systems like OpenAI's GPT and domain-specific models developed by major banks and vendors can ingest unstructured data-news articles, court filings, ESG reports-and output structured insights that plug directly into investment workflows. However, as central banks and supervisory authorities emphasize, reliance on generative AI introduces model risk, including the possibility of fabricated details, misinterpretations of nuance, or overconfident forecasts. Institutions that deploy such tools at scale are therefore building rigorous validation, human review, and red-teaming processes into their model governance frameworks, an area of practice that BizFactsDaily tracks closely in its investment and capital markets coverage.

Insurance, Risk, and the Move Toward Continuous Underwriting

The insurance sector, long characterized by periodic underwriting cycles and paper-heavy claims processes, has become a fertile ground for AI-driven reinvention. Global carriers such as Allianz, AXA, Zurich Insurance, and Ping An Insurance in China now use computer vision to assess auto damage from smartphone photos, NLP systems to triage and validate claims documentation, and anomaly detection algorithms to flag suspicious patterns across health, property, and casualty lines. In some markets, low-complexity claims are approved and paid in minutes, setting new expectations for responsiveness and transparency. Industry analyses by organizations like McKinsey & Company and Swiss Re Institute suggest that AI could automate a significant share of claims and underwriting tasks over the coming decade, reshaping cost structures and competitive dynamics.

Perhaps more transformative is the shift toward continuous, data-driven underwriting enabled by the proliferation of connected devices. Wearables, telematics, smart home sensors, and industrial IoT systems generate streams of data that allow insurers to move from static risk categories to personalized, behavior-based pricing. Health insurers in the United States, United Kingdom, Germany, and Australia increasingly experiment with wellness programs where premiums are linked to physical activity, diet, and biometric indicators, while auto insurers in markets such as Italy, Spain, and South Africa use telematics to reward safe driving habits. This evolution aligns the incentives of insurers and policyholders toward prevention rather than pure risk transfer, but it also raises complex questions around surveillance, data ownership, and the potential for discriminatory pricing. Regulators and consumer protection agencies, including those in the European Union and Canada, are therefore updating guidance to ensure transparency, consent, and appropriate limits on usage-based models.

For business readers at BizFactsDaily, the insurance use case also offers a preview of how AI can reshape broader business operations, from predictive maintenance in manufacturing to risk-based pricing in logistics, by turning real-time data into actionable risk signals.

Payments, Crypto, and the AI-Blockchain Convergence

In the payments ecosystem, AI is the invisible engine behind instant authorization, dynamic routing, and increasingly sophisticated risk scoring. Cross-border payments, historically slow and expensive, now benefit from AI models that select optimal corridors and correspondent networks, minimizing fees and settlement times. Initiatives such as RippleNet, Visa B2B Connect, and SWIFT gpi leverage machine learning to predict delays, detect anomalies, and improve transparency, while central banks and organizations like the Bank for International Settlements explore how AI can support interoperability among emerging instant payment systems and potential central bank digital currencies (CBDCs). For small and medium-sized enterprises across Asia, Africa, and Latin America, these improvements reduce friction in international trade and open new avenues for participation in global value chains.

The convergence of AI and blockchain is particularly visible in decentralized finance (DeFi), where smart contracts on public networks like Ethereum and Solana automate lending, trading, and derivatives without traditional intermediaries. Protocols such as Aave, Compound, and decentralized exchanges integrate AI-driven oracles and risk models that adjust collateral requirements, interest rates, and liquidity incentives in real time based on market conditions. At the same time, AI tools are used by security firms and analytics providers to monitor on-chain activity, identify potential exploits, and trace illicit flows, supporting enforcement efforts by agencies and multinational bodies such as the Financial Stability Board. The interplay between decentralized protocols and regulated finance raises strategic questions for banks and asset managers, many of whom are experimenting with tokenized assets and permissioned chains while monitoring innovation in the open DeFi space. Readers can follow these developments in more depth through BizFactsDaily's dedicated coverage of crypto and digital assets.

For consumers, AI-enhanced payment experiences are becoming more anticipatory and embedded, with "invisible payments" integrated into ride-hailing, e-commerce, and subscription services. Recommendation engines suggest optimal payment methods based on rewards, FX costs, and fraud risk, while conversational interfaces allow users to execute transfers and bill payments via voice or chat. This shift blurs the line between payments, budgeting, and marketing, as financial providers and merchants collaborate to deliver personalized offers and loyalty programs, an area explored in BizFactsDaily's analysis of AI-driven marketing strategies.

Regulation, Compliance, and the Quest for Trustworthy AI

As AI systems take on more consequential roles in credit, trading, and risk management, regulators across major jurisdictions are moving from high-level principles to detailed rules and supervisory expectations. The European Union's AI Act, entering phased implementation through 2026, classifies many financial AI applications-such as credit scoring and biometric identification-as "high-risk," subjecting them to strict requirements around data governance, transparency, human oversight, and robustness. Banks like BNP Paribas, Deutsche Bank, and Santander must therefore integrate AI considerations into their model risk management frameworks, internal audit programs, and board-level risk appetite statements, ensuring that algorithmic decisions remain explainable and contestable.

In the United States, agencies including the Federal Reserve, Office of the Comptroller of the Currency (OCC), Consumer Financial Protection Bureau (CFPB), and SEC have issued guidance and enforcement actions related to AI use in lending, robo-advisory, and trading. The CFPB, in particular, has emphasized that institutions cannot use the opacity of machine learning models as an excuse for failing to provide specific reasons for adverse actions, such as credit denials, under existing fair lending and consumer protection laws. The Bank of England and Financial Conduct Authority (FCA) in the United Kingdom have likewise published discussion papers and supervisory expectations on AI and machine learning in financial services, highlighting the need for cross-functional governance that spans risk, compliance, technology, and business lines. For readers tracking the macro implications of these regulatory shifts, BizFactsDaily's economy and policy coverage provides context on how AI regulation intersects with growth, competition, and innovation.

Regulatory technology (RegTech) vendors and internal compliance teams are themselves turning to AI to manage the complexity of overlapping regimes such as GDPR, CCPA, anti-money-laundering directives, and sanctions frameworks. Natural language processing is used to parse regulatory updates, map obligations to internal controls, and generate audit-ready reporting, while graph analytics and anomaly detection models identify suspicious transaction networks indicative of money laundering or sanctions evasion. Solutions from firms like Ayasdi, Darktrace, and others are increasingly integrated into banks' core compliance infrastructure. International bodies including the International Monetary Fund and World Bank encourage the responsible use of such tools, recognizing that effective supervision in an AI-driven financial system will itself require AI-enabled supervisory technology (SupTech).

At the heart of these efforts lies the broader question of trustworthiness. Financial institutions must demonstrate not only technical competence but also ethical stewardship, ensuring that AI systems align with societal expectations and legal norms. This includes rigorous testing for algorithmic bias, robust data protection practices, clear disclosures to customers, and effective redress mechanisms. For executives and boards, these issues are no longer niche technical debates but central components of enterprise risk management and brand integrity, themes that BizFactsDaily continues to highlight in its global business reporting.

Regional Patterns: Different Paths to an AI-Enabled Financial Future

While AI adoption in finance is a global phenomenon, regional trajectories reflect distinct regulatory philosophies, market structures, and technological ecosystems. In the United States, deep capital markets, a dense network of venture-backed fintechs, and the presence of large technology platforms have created an environment where experimentation and scale coexist. Neobrokers like Robinhood, payment innovators such as Stripe, and big tech firms offering embedded finance services push incumbents to accelerate AI integration across front, middle, and back office. At the same time, policymakers and academics debate the systemic implications of AI-enabled retail trading, meme stock dynamics, and the use of gamification in financial apps, topics frequently covered in BizFactsDaily's news and analysis section.

In Europe, the defining characteristic is a deliberate effort to balance innovation with rights-based regulation. The combination of GDPR, the AI Act, and sectoral rules such as the Markets in Financial Instruments Directive (MiFID II) and Payment Services Directive (PSD2) has created a complex but predictable environment in which banks and fintechs innovate within clear guardrails. Cities such as London, Berlin, Amsterdam, and Stockholm host vibrant fintech hubs focused on alternative lending, sustainable finance, and open banking, with AI at the core of many business models. European institutions are also at the forefront of integrating AI into climate and sustainability analytics, supporting the European Green Deal and the region's leadership in ESG investing. For readers interested in how innovation ecosystems evolve under tighter regulation, BizFactsDaily's innovation coverage offers comparative insights across regions.

Across Asia, the story is one of scale and speed. China's major platforms, including Ant Group, Tencent's WeBank, and state-owned banks, use AI to deliver credit, payments, and investment products to hundreds of millions of users, leveraging dense data ecosystems and advanced digital identity infrastructure. Singapore positions itself as a global hub for responsible AI in finance, with the Monetary Authority of Singapore (MAS) issuing detailed principles on fairness, ethics, accountability, and transparency while operating regulatory sandboxes that encourage experimentation. Japan and South Korea focus on modernizing legacy banking infrastructure and addressing demographic challenges through automation and digital channels. In India, AI-powered lending and payments apps ride on top of the Unified Payments Interface (UPI) and digital public infrastructure, extending financial access while prompting debates about data governance and competition. These developments illustrate how AI in finance can support rapid growth in emerging economies while requiring careful policy design to avoid concentration of power and exclusion.

In Africa, Latin America, and parts of Southeast Asia, AI and mobile technology together offer the possibility of leapfrogging traditional brick-and-mortar banking models. Services like M-Pesa in Kenya, Nubank in Brazil, and a wave of Nigerian and Indonesian fintechs combine mobile interfaces with AI-based credit scoring and fraud detection to deliver savings, credit, and insurance to previously underserved populations. International development agencies and regional regulators are increasingly focused on ensuring that these innovations contribute to inclusive growth rather than predatory lending or data exploitation. For global investors and founders, these markets present both opportunity and responsibility, as discussed in BizFactsDaily's features on founders building financial infrastructure in high-growth economies.

Workforce, Skills, and the Human-AI Partnership

AI adoption in finance is also reshaping the labor market, altering demand for skills and redefining what expertise looks like in banking, asset management, and insurance. Routine and rules-based tasks in operations, reconciliation, documentation, and basic analytics are increasingly automated through a combination of machine learning and robotic process automation. This trend affects back-office roles in major financial centers from New York and London to Frankfurt, Toronto, Sydney, and Hong Kong, prompting institutions to rethink workforce planning and talent strategies. At the same time, demand is growing for data scientists, machine learning engineers, AI product managers, model risk specialists, and cyber security professionals, creating intense competition for talent with technology firms and startups. BizFactsDaily has explored these shifts in its coverage of employment and the future of work, noting that financial institutions that invest early in reskilling and upskilling programs are better positioned to navigate the transition.

Crucially, the rise of AI does not eliminate the need for human judgment; rather, it changes where and how that judgment is applied. Relationship managers, traders, risk officers, and executives increasingly operate as overseers and interpreters of AI systems, responsible for questioning outputs, setting constraints, and making final decisions in ambiguous or high-stakes situations. Soft skills-communication, ethical reasoning, strategic thinking-gain importance alongside technical literacy. Forward-looking institutions in North America, Europe, and Asia-Pacific are therefore designing training programs that combine AI literacy with domain expertise, preparing their workforce for a model of human-AI collaboration rather than substitution.

Toward 2035: Autonomous Finance, Sustainability, and Geopolitics

Looking ahead to the 2030s, many observers anticipate the rise of what is often termed "autonomous finance," in which AI agents act on behalf of individuals and organizations across a wide range of financial decisions. Personal financial management tools could evolve into AI stewards that automatically allocate income between consumption, savings, investments, and insurance, optimizing for user-defined goals and constraints while continuously adapting to market conditions and life events. For corporations, treasury, risk management, and capital allocation functions could become increasingly algorithmic, with AI systems simulating thousands of macroeconomic and market scenarios and recommending hedging, funding, and investment strategies. Central banks and policymakers, supported by AI-driven models, may be able to simulate the impact of policy decisions with greater granularity, though they will still confront uncertainty and the possibility of model misspecification.

Sustainability considerations are set to play a central role in this evolution. As climate-related financial risks-from physical damage to transition risk-become more salient, financial institutions are integrating ESG data into their risk and investment models. AI is instrumental in processing vast quantities of climate science, emissions data, and supply chain information, enabling more accurate assessments of portfolio exposure and alignment with frameworks such as the Paris Agreement. Organizations like the United Nations Environment Programme Finance Initiative (UNEP FI) and the Network for Greening the Financial System (NGFS) work with banks and insurers to develop AI-enabled tools for climate stress testing and impact measurement. For executives and investors tracking this trend, BizFactsDaily's focus on sustainable business and finance highlights how AI can support credible, data-driven sustainability strategies rather than superficial "greenwashing."

Finally, AI in finance carries significant geopolitical implications. Countries that lead in AI research, data infrastructure, and digital financial platforms gain outsized influence over global capital flows, standards, and norms. The strategic competition between the United States and China in AI, semiconductors, and digital payments is already shaping alliances, trade policy, and the development of cross-border payment systems and CBDCs. The European Union seeks to exercise normative power through regulation and standard-setting, while regions such as Southeast Asia, Africa, and Latin America navigate a multipolar environment, balancing partnerships and technology choices. Financial sanctions, capital controls, and economic statecraft are all likely to be mediated by AI-enabled monitoring and enforcement systems, reinforcing the need for global coordination through bodies such as the IMF, FSB, and BIS. For global business leaders, understanding AI in finance is therefore not only a question of technology or profitability but also of geopolitical risk and strategic positioning.

Conclusion: Building an AI-Enabled Financial System Worth Having

By 2026, AI has become inseparable from the functioning of modern finance, from the credit decisions that shape household and business opportunities to the trading algorithms that move trillions of dollars across markets each day. The sector is more data-driven, more personalized, and in many respects more efficient and inclusive than it was a decade ago, yet it is also more complex and interdependent, with new forms of model risk, cyber vulnerability, and ethical tension. For the readership of BizFactsDaily, which spans executives, investors, founders, policymakers, and professionals across North America, Europe, Asia, Africa, and Latin America, the central challenge is to harness AI's capabilities while preserving the resilience, fairness, and trust on which financial systems ultimately depend.

Achieving this balance will require disciplined governance within institutions, robust and adaptive regulation, international cooperation, and a sustained commitment to human expertise and accountability. It will also demand continuous learning, as models, markets, and threats evolve. Those organizations that treat AI not as a black box to be exploited but as a powerful tool to be understood, governed, and aligned with long-term stakeholder interests are most likely to thrive in the emerging era of autonomous and sustainable finance.

For ongoing, practical insights into how AI is transforming banking, markets, employment, and business strategy worldwide, readers can explore the broader coverage and analysis available at BizFactsDaily.